Thieves Are Draining $38.5 Billion From Seniors — Here's How to Fight Back

Sep 29, 2025

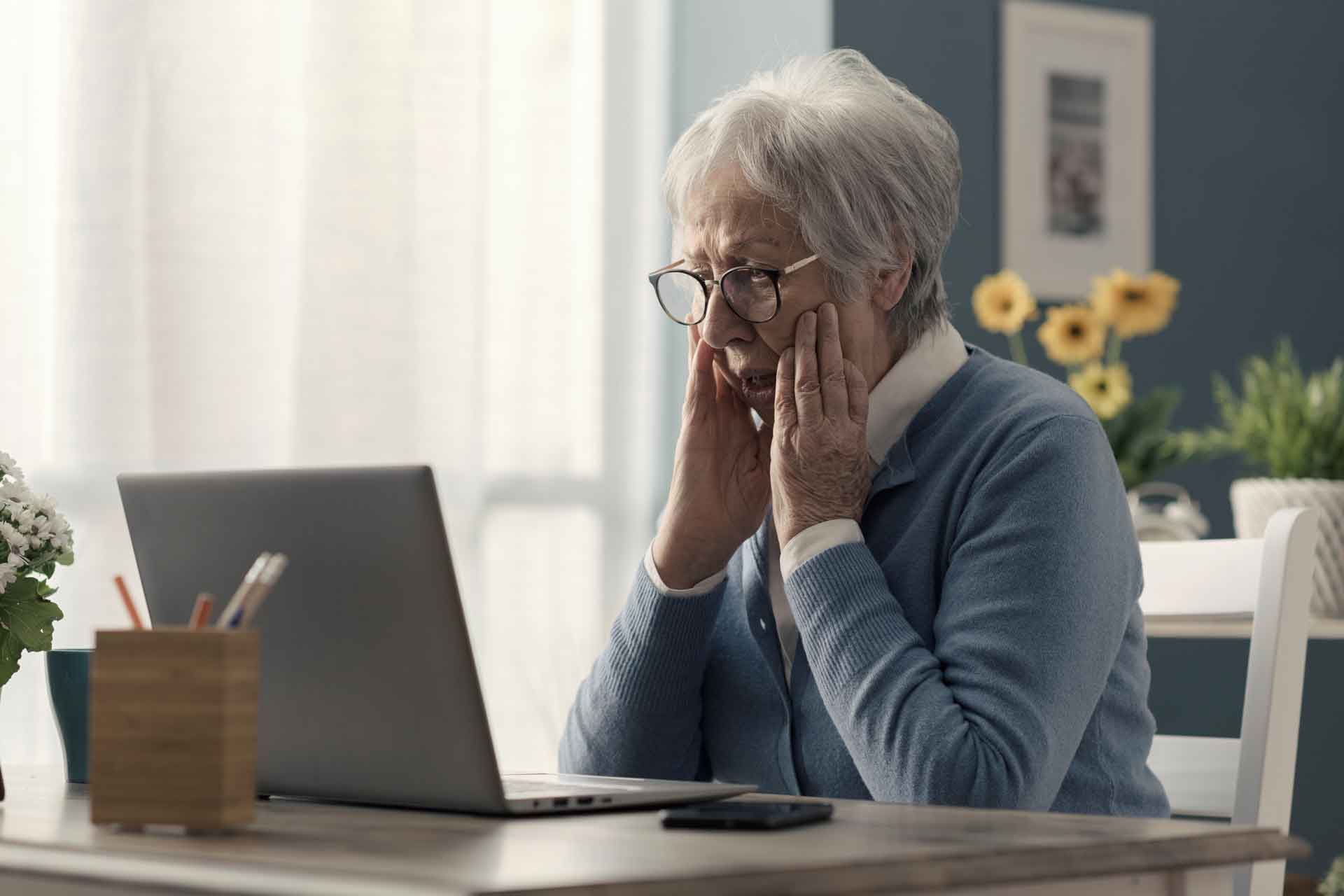

We lock our doors, shred our mail, and warn our grandkids about online scams. So why are older Americans still losing $83,000 per fraud complaint, on average?

That shocking figure comes from the AARP, which reports total losses among people aged 60 and over have ballooned to $38.5 billion annually. Nearly half of American adults say they or someone they know has been targeted. Financial exploitation is not just a handful of scam calls or shady emails. It’s a growing threat to one of the most trusting and vulnerable populations. So how did we get here, and more importantly, what can we do about it?

More ways to safeguard your finances

| Provider | Special Offer | Take Action |

|---|---|---|

| National Debt Relief | Be debt free in as little as 12-48 months | Get Free Consultation |

| American Home Shield | 50% off select plans | Get Free Quote |

| Charlie | Get Social Security payments 3-5 days early | Sign up for free |

| Branded Surveys | Earn cash and gift cards for sharing opinions | Sign up to start earning |

| T-Mobile | 5G unlimited internet for just $35 a month | Get a 15-day free trial |

A New Breed of Scam

Today’s scams don’t always look like scams. There are no Nigerian princes or poorly spelled emails. Instead, seniors are targeted by convincing romance scams, tech support impersonators, and even scammers pretending to be grandchildren in trouble.

These criminals are increasingly sophisticated. They use spoofed caller IDs, deepfake voice cloning, and fake websites that mimic trusted institutions. Some even send legitimate-looking invoices or demand payment through gift cards and cryptocurrency.

What they all have in common is urgency. “You must act now or you’ll lose everything” is a line many scammers use to override logic with fear. Once that emotional trigger is pulled, even the most cautious person can fall victim.

One helpful step in reducing exposure is to minimize financial complexity. National Debt Relief provides a direct and effective solution by helping older adults consolidate their debts into a single, manageable repayment plan. With a free debt consultation and personalized support, it enables seniors to reduce what they owe, simplify their finances, and regain a sense of control over their money.

Why Older Adults Are Targeted

Fraudsters go where the money is. Seniors often have retirement accounts, home equity, and steady income from Social Security or pensions. That alone makes them attractive targets.

But it’s more than just money. Many older adults live alone or are socially isolated. They might not have someone to sense-check a strange email or suspicious phone call. Even mild cognitive decline can impair judgment.

There’s also trust. Older generations were raised in an era where politeness and deference to authority were the norm. That can become a dangerous mindset when facing manipulative con artists.

Worse yet, many victims never report what happened. Embarrassment, shame, or fear of losing financial independence keep them silent.

Real People, Real Losses

Behind every statistic is a story. Like the retired teacher who thought she was helping her grandson post bail, only to realize too late that it wasn’t him on the phone. Or the widow who transferred $50,000 to a man she met on a dating site, believing they were planning a future together.

The emotional toll is as damaging as the financial loss. Victims often face depression, anxiety, and a profound sense of betrayal. Relationships can fracture when families find out too late.

Audien Hearing Aids provide a simple but powerful solution for maintaining clarity and connection with a set of affordable hearing aids. With rechargeable, nearly invisible hearing devices under $100, they help seniors hear more of the world around them, from conversations with loved ones to warning signs of potential scams. Better hearing leads to better awareness, which is critical in avoiding fraud.

What’s Being Done and Where the Gaps Remain

Legislation like the Senior Securities Protection Act of 2025 is a step forward. It empowers financial professionals to delay suspicious transactions and report potential exploitation.

Banks and payment networks are also stepping in, using AI to detect unusual patterns and flag potentially fraudulent transfers.

AARP’s Fraud Watch Network and the Consumer Financial Protection Bureau (CFPB) offer resources to help seniors spot scams. But awareness alone isn’t enough. Families and communities need to stay involved.

How You Can Help Protect Loved Ones

Start by having regular conversations about money, not just budgets and bills, but scams and security. Make it safe for loved ones to share their concerns without judgment.

Here are a few practical tips:

- Set up transaction alerts for unusual account activity.

- Encourage use of a password manager.

- Designate a trusted contact at banks and investment firms.

- Watch for red flags like sudden secrecy, late bills, or gift card purchases.

Most importantly, stay connected. A quick phone call can do more than lift someone’s spirits; it might stop a scam in its tracks.

Charlie goes beyond traditional banking by offering tools designed specifically for those 62 and older, including FraudShield protection, early access to Social Security, and real-time alerts on spending. With smart money tools, no monthly fees, and U.S.-based support, it empowers seniors to manage their finances with confidence and clarity.

It’s not a government payout, but this senior-friendly bundle of solutions is helping older Americans unlock real financial relief when they need it most.

Don’t Wait for It to Happen

Fraud doesn’t discriminate. It doesn’t care about how careful, smart, or skeptical someone is. What it exploits is opportunity, and those opportunities are everywhere.

The good news? With the right information, support systems, and tools, financial exploitation is preventable.

If you or someone you care about is over 60, now is the time to start the conversation. Because no one deserves to spend their golden years recovering from betrayal.

This is also the time to consider building a broader safety net, one that includes both community and advocacy. An AARP Membership offers more than just discounts. It gives older adults access to trusted resources, fraud education, and exclusive savings on everyday essentials. For just $15 your first year, it’s an easy way to stay protected and informed through one of the most established names in senior advocacy.